Catching a cold is just like having a red stock market portfolio.

No matter how hard you try to avoid it, it will find its way to weaken your immune system.

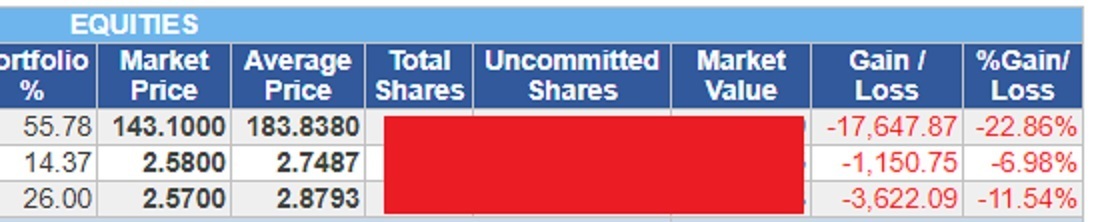

No matter how hard you try to keep your portfolio green, the red color finds its way to flood your portfolio with bloody ink indicating a loss.

However, it doesn’t matter how many viruses enter your system, or how often your green portfolio is washed away by a bloody color, this won’t stop you from thriving because these circumstances shall pass.

Though you sometimes catch a cold or accumulate paper losses, you survive because life is a cycle, a cycle of ups and downs.

Recovery comes after every cold virus infection

When you catch a cold, you will recover after several days.

I don’t know about you but when I catch a cold I take too much hot liquid, take pills, eat food, have lots of sleep to shorten my recovery period and rub Vicks Vapor Rub on my back and chest to help ease my discomfort from my clogged nose.

It’s the same thing with your stock market investment.

When the market is down and your portfolio turns red, you make moves to minimize your loss.

The thing is, we should take preventive measures so that the simple cold won’t turn into a more serious illness.

Also with your stock portfolio, to minimize great loss and bankruptcy, precautions should be undertaken.

Don’t Lose Hope In A Down Market

Red stock market portfolio can’t be avoided no matter how hard you try to get away from it but there’s no need to panic because there are ways to minimize your losses and still grab good positions or opportunities even the market is down.

Naturally, whatever goes up, goes down and whatever goes down, goes up.

If I may still go for more chilche’s, “There’s a rainbow after a rain” or “When God closes the door, He opens a window”. However, success in stock market investing does not just depend on hope but it also entails learning, action, and patience.

Invest Cautiously By Choosing A Good Company, Starting Small And Buying Shares Regularly

To shield your body from frequently catching a cold, the doctors usually advise you to take vitamins, eat healthily, do regular exercises, and get enough sleep. And most importantly, to survive a health-threatening condition, you must follow this advice regularly.

To Survive In A Down Market…

- choose a good company

- start small

- buy shares regularly

- most importantly…Do NOT Panic

By choosing the company with a good track record and durable competitive advantage to invest in will help you to sleep soundly at night.

By putting your money on a Blue chip, you are assured that since this company may even outlive you, your money has the least risk to just vanish in the thin air the next morning when you wake up.

By starting small you may lessen the risk to lose more when the market suddenly goes down.

By buying shares regularly you may maximize your gains by maintaining a lower average buying price.

By NOT panicking, you will be able to think properly and device ways to take the opportunity of the ongoing crisis to your advantage.

You will be able to decide whether…

- you hold your position, or

- cut your loss and switch to another better performing company,

- or average down the buying price of your shares.

Do you think you can survive in a down market?

Visit the Stock Market Start Up Basket to learn more about how to thrive even if the market is down.

TIP: A good stock market investor still knows how to make his money grow even the market is not performing well.

———–

P.S. 1: If you liked this post, please feel free to share it with your friends. In the meantime, I invite you to join our subscription list to download your free e-book, Teacher’s Guide To Stock Market Investing.

P.S. 2: If you like to learn how to choose the best stocks to buy to maximize your earnings in the Philippine stock market, click here to get a copy of the Stock Market Start Up Basket