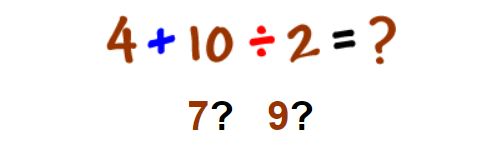

Quick Simple Question Here

What’s the answer to

If you are a Math teacher or someone who is good at math, easy peasy lang ito sa ‘yo.

By following the MDAS rule, you already know the answer.

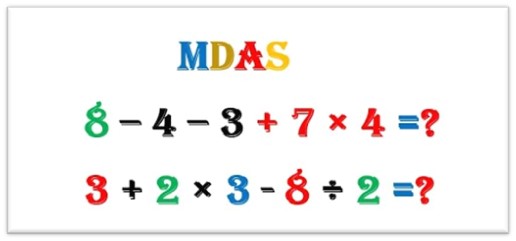

Are you still familiar with MDAS?

If you listened to your Math teacher in elementary or high school, you remember what MDAS stand for.

But just in case you were absent, MDAS represents the order of 4 mathematical operations: Multiplication, Division, Addition, and Subtraction.

Sounds familiar?

When I heard this and applied it in solving the mathematical problems in Algebra, to my surprise, hindi na ako na-ze-zero. Hindi man perfect score but at least, passing scores.

If MDAS works with my Algebra, definitely mag-wo-work din ang MDAS sa Stock Market.

What is the MDAS of Stock Market Investing/Trading?

Ready ka na?

Here it is…

M – Multiplication

Multiply yourself to multiply your money.

Picture this…

After breakfast, you multiplied into 4 bodies. Then you all dress up and go to work.

That would be awesome because you won’t be alone earning for yourself. Your other 3 selves are also out there making money. More selves to work, more product to expect, di ba?

Then, at the end of the day, you all go home, and these four bodies are again merged into one before dinner.

Is that even possible?

You know, there is a way to multiply ourselves in the stock market.

By investing your money in the stock market, you are multiplying yourself by letting your money work for you while you keep working for money in your job.

See, we have 24 hours a day but surely you cannot work 24 hours a day to make money. From your 8-5 job, you even need time to rest in between. But when you invest your money in the stock market, the money can keep working for you while you are taking a break.

D – Division

Divide your money to different basket. Diversify.

There are different companies under different sectors or industries in the stock market.

Divide your money and put them in different stocks under different sectors.

Like the cliche’, “Do NOT put all your eggs in ONE basket”

This is particularly important because if one industry lags in performance due to untoward incidents such as natural disasters, political situations, pandemic then your stocks from the resilient sectors will still pull you through.

However, there is a reminder here as well.

Be careful not to over diversify. Do not spread your money thinly.

A – Addition

Allow yourself to be aware. Start by discovering how to begin. Constantly add knowledge and skills.

Determine how you will invest your money in the stock market and regularly add and develop your investing or trading strategies.

Remember that investing differs with trading thus there are strategies that are only special for investing as well as for trading.

When investing, buying additional stocks regularly is also helpful.

The more stocks you have the more opportunity to earn bigger gains and if you buy stocks that give dividends, then more opportunity to receive more dividends.

It is also important to note that it is more important to accumulate gains than accumulate losses.

That is why in trading, they say “gain is gain” no matter how small it is.

S – Subtraction

The most important thing to subtract when investing and especially when trading in the stock market is emotion.

It is easier said than done however, learning to subtract your emotion when buying or selling stocks will do a great favor in multiplying your money.

In trading and also in investing, I have identified 2 kinds of emotions that hinder us in multiplying our money in the stock market.

#1 The fear of missing out

You fear that you are missing the opportunity to earn, so you chase high flying stocks.

You fear that you will miss out on the opportunity to earn more so you hesitate to sell your stocks even if you already hit your target price.

#2 The fear of losing

You fear that you are going to lose your capital investment, so you sell your stocks at loss.

Another thing to subtract is a negative attitude. Two of them is impatience and laziness.

You are impatient to wait for the return. This is especially true in investing. Because you are impatient, you will sell your position at loss and start chasing more volatile stocks.

In addition to that is Laziness.

You are lazy to learn so you just depend on other people’s opinion. Because of that, you are easily hyped by noise you hear on the news or social media.

Subtracting emotions when investing and trading will make a difference in result.

Remember this MDAS of investing/trading in the stock market para hindi ka na laging zero.

Click to order your Usana Needs

P.S.1. If you are blessed by this post, share the blessing also to your loved ones and friends by sharing this post to them.

P.S.2. I am inviting you to visit and join us in our Facebook Group https://www.facebook.com/groups/isavenvestify

P.S.3. If you also want to learn how to invest in the stock market, get your FREE ebook that teaches how by filling in the form below

Thank you for sharing your knowledge.happy new year

You’re welcome you Mam Daisy. Happy New Year.

Are you considering investment opportunities in Iraq? BusinessIraq.com is your gateway to understanding the potential and risks associated with investing in this rapidly evolving market. We provide comprehensive coverage of investment laws, bureaucratic processes, and emerging business sectors ripe for growth. Our articles offer expert analysis on the Iraqi business climate, helping you identify profitable ventures and navigate potential challenges. From infrastructure projects to agricultural advancements, we highlight potential areas of high return, offering a nuanced perspective on both the opportunities and risks in various sectors. Learn about accessing funding, partnering with local businesses, and understanding the cultural nuances that impact the investment process.

BusinessIraq.com maintains dedicated coverage of Iraq’s private sector developments, featuring news about major corporate expansions, market entries, and business partnerships. As reported by aljazeera.com, our platform provides in-depth analysis of business climate improvements, regulatory reforms, and emerging commercial opportunities across various sectors, helping readers navigate Iraq’s evolving business landscape.

BusinessIraq.com leverages robust data and statistics to support its reporting. We provide accurate and detailed information on key economic indicators, market trends, and business performance. Access detailed charts, graphs, and tables for a deeper understanding of Iraqi business realities. Reliable, verifiable data underpins all reporting for the informed user.

For strategic market entry, understanding local cultures and business practices is vital Iraq Business News provides context and background to help international businesses navigate these complexities

Good https://is.gd/tpjNyL

Awesome https://lc.cx/xjXBQT

https://shorturl.fm/TbTre

https://shorturl.fm/bODKa

https://shorturl.fm/N6nl1

https://shorturl.fm/9fnIC

https://shorturl.fm/XIZGD

https://shorturl.fm/oYjg5

https://shorturl.fm/FIJkD

https://shorturl.fm/FIJkD

https://shorturl.fm/N6nl1

https://shorturl.fm/68Y8V

https://shorturl.fm/FIJkD

https://shorturl.fm/j3kEj

https://shorturl.fm/FIJkD

https://shorturl.fm/68Y8V

https://shorturl.fm/9fnIC

https://shorturl.fm/XIZGD

https://shorturl.fm/bODKa

https://shorturl.fm/j3kEj

https://shorturl.fm/xlGWd

https://shorturl.fm/fSv4z

https://shorturl.fm/uyMvT

https://shorturl.fm/Kp34g

https://shorturl.fm/LdPUr

https://shorturl.fm/47rLb

https://shorturl.fm/PFOiP

https://shorturl.fm/Kp34g

https://shorturl.fm/TDuGJ